Mastering Simple Scalping: A Trend Following Approach

Today, we are excited to present an effective and efficient scalping strategy that revolves around one key technical indicator: the EasyTrendFollower. In this presentation, we will delve into the ins and outs of this powerful indicator and demonstrate how it can be used to identify potential trading opportunities for scalpers in the financial markets.

Scalping, as you may know, is a trading technique that focuses on capturing small price movements within a short timeframe. Scalpers execute numerous trades throughout the trading day, aiming to take advantage of small price differentials between the bid and ask prices.

The EasyTrendFollower indicator, our star of the show, is a trend-following technical tool that provides valuable insights into the current market trend. By examining its position relative to the price chart, we can identify the entry and exit points.

Throughout this presentation, we will cover the key components of this indicator, the entry and exit criteria for our scalping trades, risk management techniques.

Understanding Scalping

Scalping is a popular trading technique that focuses on making rapid profits by exploiting small price movements. Unlike traditional long-term investing, scalpers are not concerned with the underlying value of an asset; rather, they capitalize on short-term price volatility to execute multiple trades within a single trading session.

1. Short Timeframes: Scalping trades typically last from a few seconds to a few minutes. Traders aim to enter and exit the market

swiftly to avoid exposure to prolonged price fluctuations.

2. High-Frequency Trading: Scalpers execute numerous trades throughout the trading day, seeking to accumulate profits over multiple small gains.

3. Small Profit Targets: Scalpers set modest profit targets for each trade, relying on the cumulative effect of multiple successful trades to achieve significant gains.

4. Strict Risk Management: Due to the high frequency of trades, risk management is paramount. Scalpers employ tight stop-loss orders to protect against adverse price movements.

5. Liquid Markets: Scalping is most effective in highly liquid markets, where there is sufficient trading volume and tight bid-ask spreads.

While scalping can be a highly profitable trading strategy, it requires discipline, precision, and the ability to make quick decisions. Traders employing this technique should be mindful of transaction costs, as frequent trades can add up.

Introducing the EasyTrendFollower Indicator

This indicator is a popular and versatile technical tool that helps traders identify market entry and exit points.

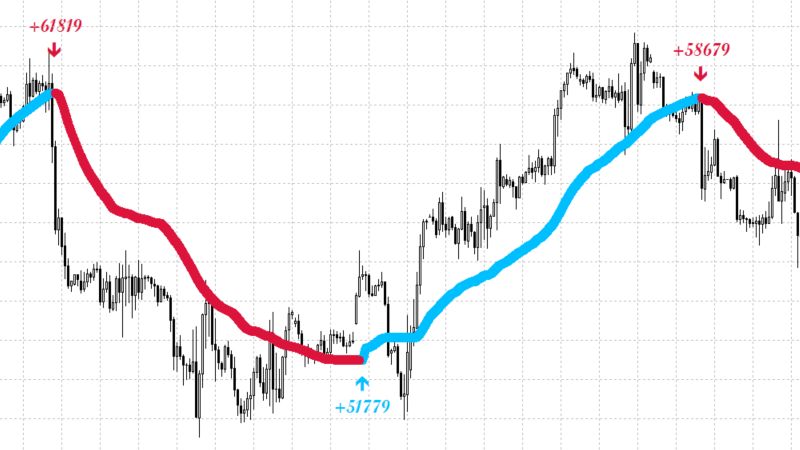

1. Bullish Trend: When the indicator line is displayed below the price chart in blue color, it indicates an uptrend.

This suggests that the stock's price is likely to move upwards, and traders may consider long positions.

2. Bearish Trend: Conversely, when the indicator line is displayed above the price chart in red color.

This implies that the stock's price is likely to decline, and traders may consider short positions.

1. Adaptive Nature: The indicator adapts to changing market conditions and captures both short-term and long-term trends effectively.

2. Visual Simplicity: The indicator appears as a single line above or below the price chart, making it easy to interpret and incorporate into trading strategies.

3. Trend Confirmation: By aligning with the prevailing trend, the indicator helps traders avoid potential false signals and increases the probability of successful trades.

4. Stop-Loss Placement: The indicator line can also be used as a dynamic stop-loss level, aiding traders in protecting their gains and managing risk.

Entry And Exit Criteria

M5, M15, or M30

Any

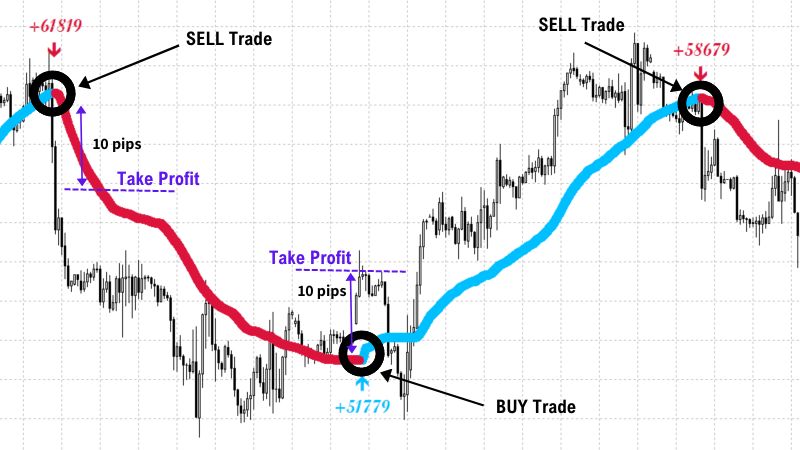

When the indicator line turns red and crosses from below the price above the price, this is a sell signal. The trader can open a sell order and place the stop loss on the indicator's red line.

When the indicator line turns blue and moves from above the price to below the price, this is a buy signal. The trader can open a buy order and place the stop loss on the indicator's blue line.

Set a tight profit target to capture small price movements effectively, relying on the cumulative effect of multiple successful trades to achieve significant gains. If the indicator line reverses during a trade, consider exiting to lock in profits.

Risk Management

Successful trading is not just about finding profitable opportunities; it also involves safeguarding our capital through prudent risk management. As we implement the simple scalping strategy, let's focus on key risk management principles to protect our gains and maintain consistency in our trading endeavors.

- Determine the maximum percentage of your trading capital you are willing to risk on each individual trade. This is commonly known as "risk per trade" or "position sizing".

- Scalpers often risk a small percentage of their capital per trade, typically ranging from 1% to 3%, considering the higher frequency of trades.

- Always use stop-loss orders to limit potential losses on each trade.

- Scalpers set modest profit targets for each trade. Once the target is reached, consider closing the position and securing the profit.

- Avoid the temptation to hold onto a winning trade in hopes of more significant gains, as this may expose you to potential reversals and erode profits.

- While leverage can amplify gains, it also magnifies losses. Avoid over-leveraging, especially in a fast-paced scalping strategy.

- Always use leverage responsibly and be aware of its impact on your trading capital.

- Frequent trading in scalping can lead to higher transaction costs. Be mindful of commissions and spreads, as they can affect overall profitability.

- Consider using brokers with competitive commission rates and tight spreads to minimize costs.

- Emotions can impact decision-making in trading. Stick to your trading plan, and avoid making impulsive decisions based on fear or greed.

- Maintain discipline in following the EasyTrendFollower signals and adhering to your risk management rules.

Conclusion

The simple scalping strategy offers traders a powerful and intuitive method to profit from short-term price movements. Its simplicity, adaptability, and effectiveness in identifying trends make it a valuable tool for traders seeking to maximize gains in fast-paced and dynamic market environments.

As we embrace the advantages of this indicator, let's continue to refine our skills through backtesting, demo trading, and disciplined risk management. The journey to successful scalping requires dedication, but with the EasyTrendFollower by our side, we are well-equipped to conquer the challenges and opportunities presented by the financial markets.