Double Confirmation Forex Scalping Strategy: Unbeatable Combo

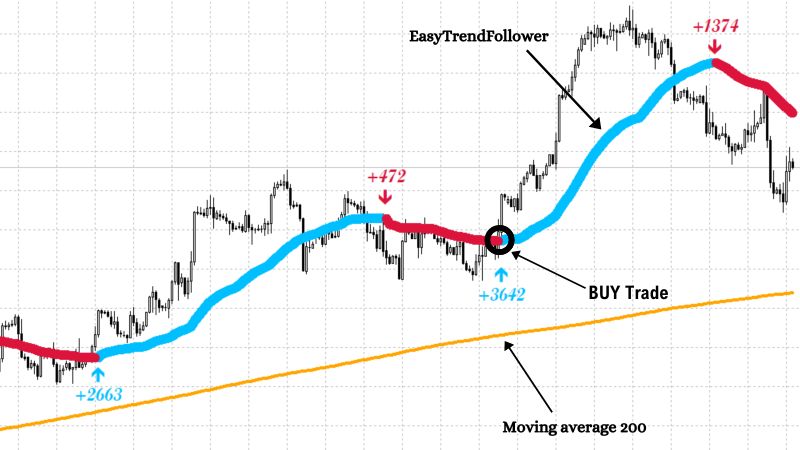

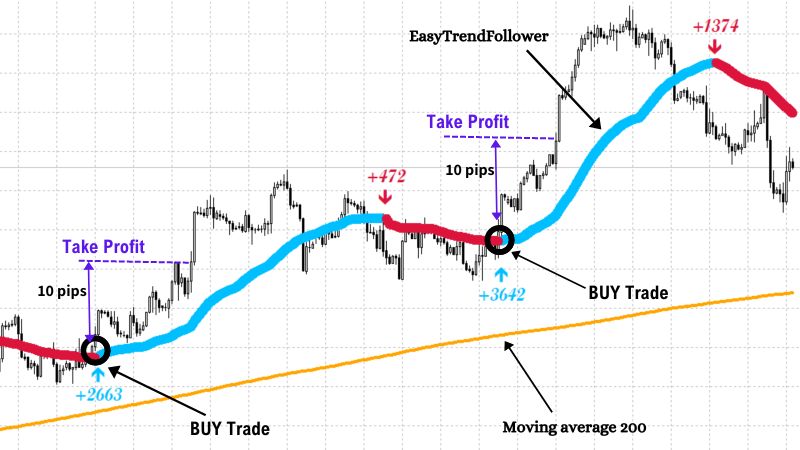

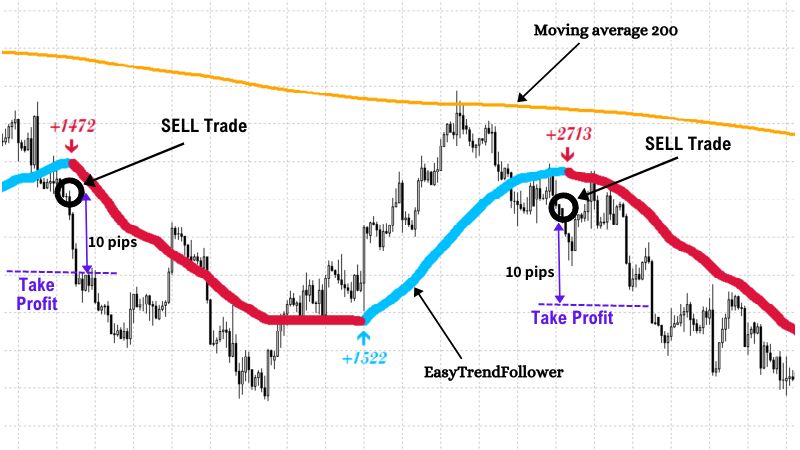

Welcome, everyone! Today, we will delve into an effective scalping strategy that combines the power of two technical indicators: the EasyTrendFollower Indicator and the 200 Moving Average. Scalping is a popular short-term trading approach that aims to profit from small price movements. Our strategy adds an extra layer of confirmation to increase the probability of successful trades.

Understanding Scalping

- Scalping is a high-frequency trading technique focused on capturing small price movements.

- Traders execute multiple trades throughout the day, aiming to accumulate profits over time.

- It requires quick decision-making, discipline, and risk management.

The EasyTrendFollower Indicator

The EasyTrendFollower Indicator, a fundamental component of the Double Confirmation Strategy, is a popular and powerful technical tool utilized by traders to identify trends and potential entry and exit points in the financial markets.

1. Volatility-Based Calculation: It incorporates market volatility in its calculation.

This dynamic feature allows the indicator to adjust to changing market conditions, providing more accurate signals in varying volatility environments.

2. Entry and Exit Points: A buy signal is generated when the indicator color changes from red to blue, while a sell signal is triggered when the indicator color changes from blue to red.

3. Trailing Stop Loss: This indicator can be employed to set dynamic stop-loss levels. During an uptrend,

the stop-loss level trails the indicator line to protect profits, while in a downtrend, it moves below the indicator line to mitigate potential losses.

4. Suitable for Various Timeframes: The flexibility of the Indicator allows it to be used across different timeframes, catering to the needs of various trading styles.

Entry Rules

M5 or M15

Any

Step 1: Check if the EasyTrendFollower indicator has changed from red to blue.

Step 2: Confirm that the price is trading above the 200 Moving Average, indicating a favorable long-term trend.

Step 3: If both conditions are met (EasyTrendFollower has changed from red to blue and price above the 200 MA), a Buy Signal is generated.

Step 1: Check if the EasyTrendFollower indicator has changed from blue to red.

Step 2: Confirm that the price is trading below the 200 Moving Average, suggesting a negative long-term trend.

Step 3: If both conditions are met (EasyTrendFollower red and price below the 200 MA), a Sell Signal is generated.

Risk Management

- Scalping involves quick trades, so risk management is crucial.

- Set tight stop-loss orders to limit potential losses.

- Use appropriate position sizing to avoid overexposure.

Conclusion

In this presentation, we explored a powerful scalping strategy that utilizes the EasyTrendFollower Indicator and the 200 Moving Average to enhance trade accuracy and increase the probability of successful trades.

1. Reducing False Signals: By waiting for confirmation from both the EasyTrendFollower Indicator and the 200 Moving Average,

we can filter out noise and avoid taking trades based on single, potentially unreliable signals.

2. Enhancing Trend Identification: The EasyTrendFollower Indicator identifies entry points, while the 200 Moving Average

smoothes out price data to provide additional trend confirmation.

3. Increased Confidence in Trades: When both indicators align and confirm a trade, it instills greater confidence in the trade setup, making it easier to execute with conviction.

1. Discipline and Patience: Successful scalping demands discipline and patience. Stick to your trading plan, wait for double confirmation, and avoid impulsive decisions.

2. Risk Management is Paramount: Scalping involves quick trades, and risk management is crucial. Set tight stop-loss orders, limit position sizes, and avoid overtrading.

3. Stay Informed: Keep yourself updated with market conditions, economic events, and changes in sentiment.

By implementing the Double Confirmation Scalping Strategy with the EasyTrendFollower Indicator and the 200 Moving Average while adhering to sound risk management principles, you can position yourself for potentially successful scalping opportunities.